income tax payment malaysia

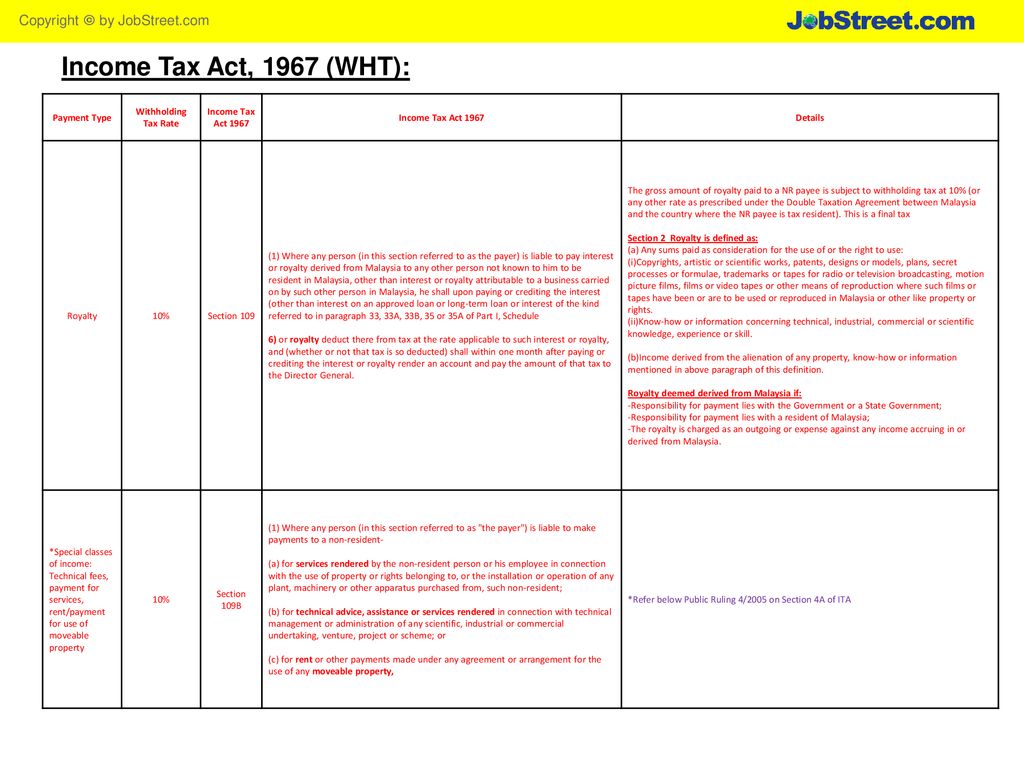

If taxable you are required to fill in M Form. Contract payments to non-resident contractors are subject to a total withholding tax of 13 10 for tax payable by the non-resident contractor and 3 for tax payable by the contractors.

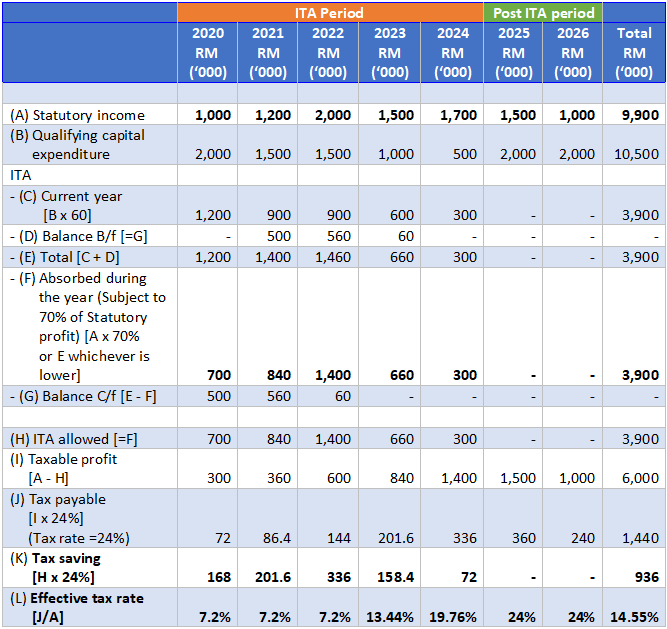

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

This income tax calculator makes standard assumptions to provide an estimate of the tax you have to pay for 2021.

. The following are some tax penalties depending on the offence committed. Information on Taxes in Malaysia. New e-Telegraphic Transfer System for Tax Payments Following to the Malaysian Inland Revenue Board MIRBs media release on 3 March 2022 the MIRB has rolled out the new e-TT system.

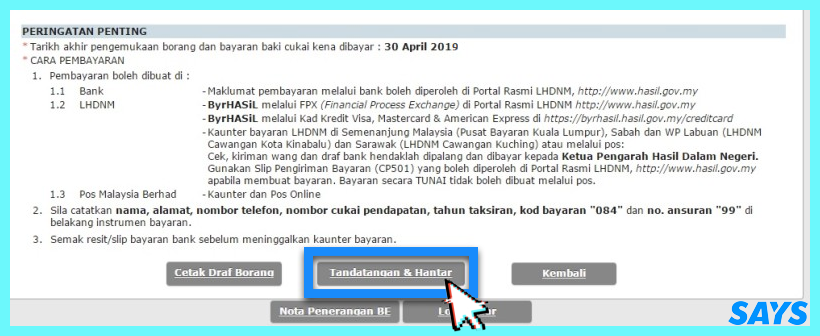

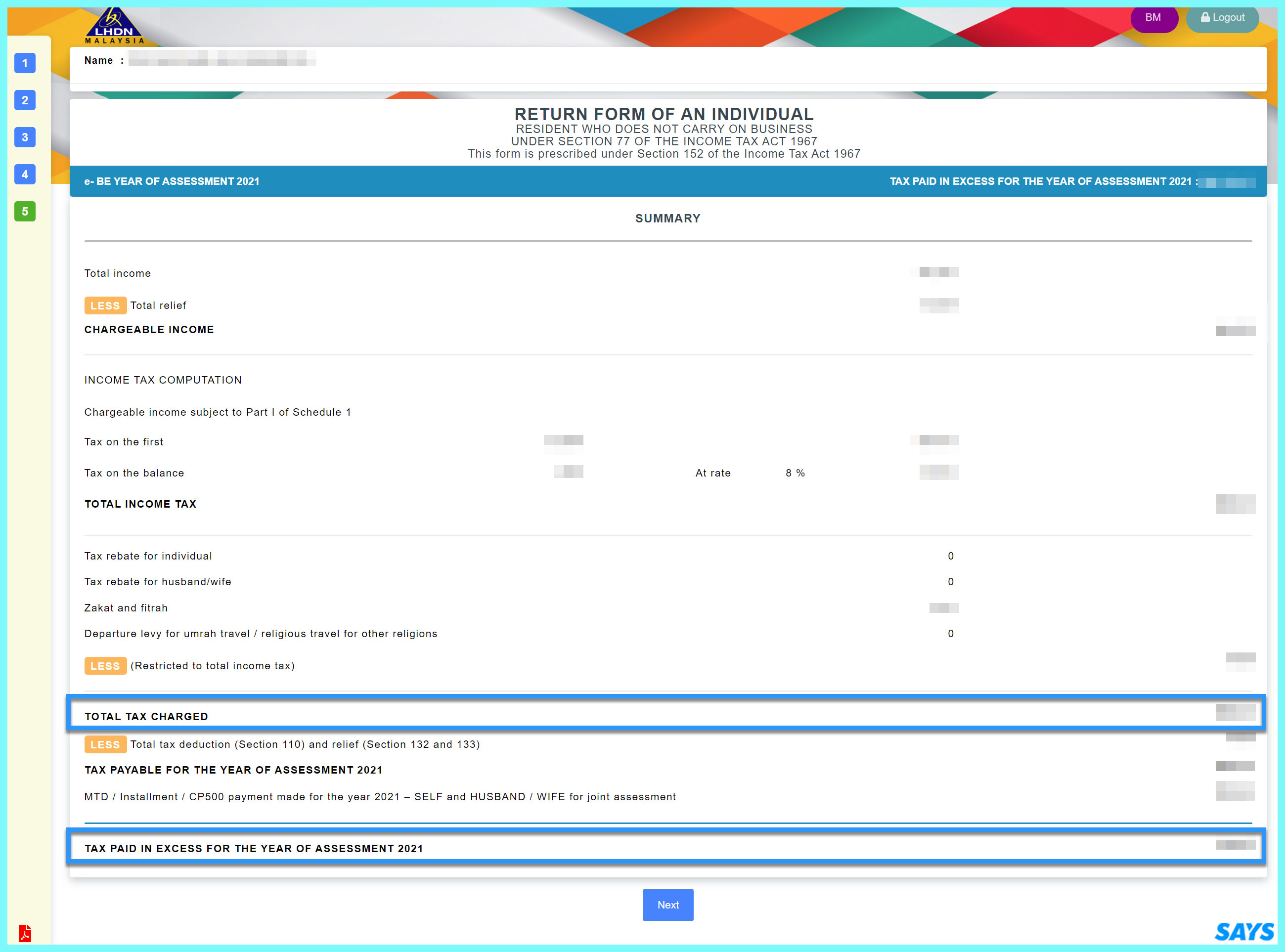

Some Tax Penalties in Malaysia You May Not Be Aware of. 15 Oct 2022 Melayu Payment Via FPX 13 - Identification Information 23 - Payment Information 33 - Bank Information ANNOUNCEMENT Effective from 7 July 2015 the PayNet. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040.

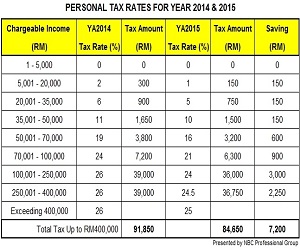

Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the. Malaysia Personal Income Tax Rate A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum. Malaysia has implementing territorial tax system.

There are many methods to pay income tax payment in Malaysia. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30. At the time of writing personal income tax for Malaysian tax residents is progressive from 1 - 30 depending on income level.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Both residents and non-residents are taxed on income accruing in or derived from Malaysia. Pay income tax by online banking account FPX Pay income tax by credit card Pay income tax by cheque.

However if you claimed RM13500 in tax. The non-resident tax rate in Malaysia is. Number of months within the basis period 12 bulan Tax Estimate RM12000 Monthly Installments RM12000 RM12000 12 RM1000.

You can report and pay your tax electronically in most cases in Malaysia. Our calculation assumes your salary is the same for 2020 and 2021. You can pay your tax by a bank transfer over the counter in a bank at an ATM or even on the phone.

It is advisable to settle your income tax. RM12000 12 RM100000. Total months in the basis period Tax Estimation Monthly Installments.

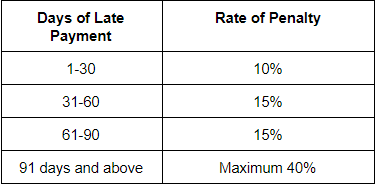

Failing to furnish income tax return. If you fail to pay income tax within 60 days after the respective due dates therell be an additional 5 tax penalty imposed on top of your tax payments. This is a form of payment where employees could have additional monthly deductions from their salaries besides the usual SOSCO and EPF deductions to pay off their.

Tax Payment Via Credit Card Taxpayers can make payments of income tax and real property gains tax using a credit card online at httpsbyrhasilhasilgovmycreditcard These services. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable.

How To File Income Tax For The First Time

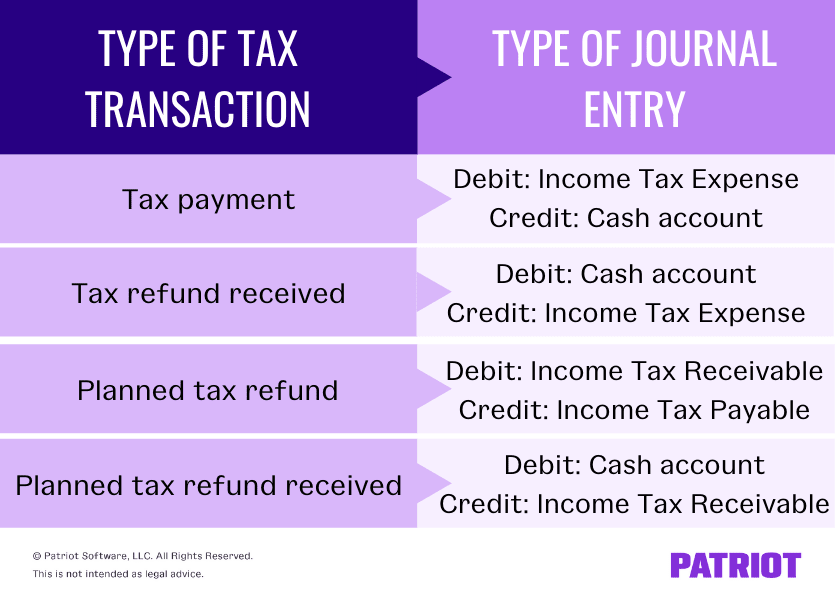

Journal Entry For Income Tax Refund How To Record In Your Books

How To Calculate Monthly Pcb Income Tax In Malaysia Mkyong Com

Malaysia Tax Penalty For The Late Payment Of Tax

Finance Malaysia Blogspot Ya2017 Tax Relief For Personal Income Tax Filing

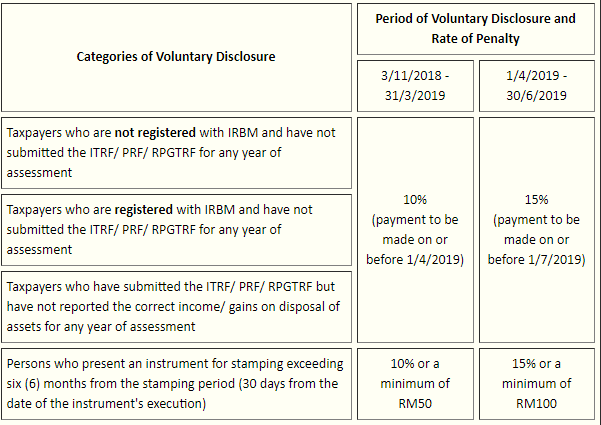

Declare Your Income Tax Now Get A Lower Penalty Rate Speedhome

7 Things To Know About Income Tax Payments In Malaysia

Income Tax Malaysia 2022 Basic Guide For Beginners Youtube

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Ks Chia Tax Accounting Blog New Tax Payment Receipt

1 Statistic On Income Tax Payment Received Through Online Channels In 2007 Download Table

Personal Tax Archives Tax Updates Budget Business News

Pr Po Process Flow By Jace Cheah Ppt Download

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

How To File Income Tax For The First Time

The State Of The Nation Finding Room To Lighten The Middle Income Tax Burden The Edge Markets

Comments

Post a Comment